-

For Information:

8383097941 -

For Support:

8383097941 -

Mail Us:

snowmoonsolutionsindia@gmail.com

For Information:

8383097941For Support:

8383097941Mail Us:

snowmoonsolutionsindia@gmail.comOutstanding debts create a ripple effect across your organization. Cash flow constraints impact operational capabilities, limit growth opportunities, and strain business relationships. In India’s dynamic business environment, where payment cycles can extend unpredictably, professional debt recovery isn’t just beneficial—it’s essential for maintaining financial health.

Organizations that lack systematic recovery processes typically write off 15–25% of receivables as bad debt, significantly eroding profit margins. Every rupee trapped in overdue accounts represents working capital that could fuel expansion, innovation, or competitive advantage.

Professional debt recovery services deliver more than collected funds. They preserve valuable client relationships through diplomatic, legally compliant engagement. They free internal resources from time-consuming collection efforts, allowing your team to focus on core business activities.

Most importantly, they establish credibility in the marketplace. When vendors and partners know you have robust recovery mechanisms, payment discipline improves across your entire business ecosystem. This preventive effect often exceeds the value of actual collections.

Delhi NCR, Punjab, Haryana, Rajasthan, Uttar Pradesh, and Jammu & Kashmir

Karnataka, Tamil Nadu, Kerala, Andhra Pradesh, Telangana, and Puducherry

West Bengal, Odisha, Bihar, Jharkhand, and the Seven Sisters of Northeast India

Maharashtra, Gujarat, Goa, Madhya Pradesh and Chhattisgarh

Our panel of experienced advocates specializes in commercial litigation, arbitration, and debt recovery proceedings. They handle everything from demand notices and negotiation to filing recovery suits, insolvency applications under IBC, and enforcement of decrees. With expertise across civil courts, Debt Recovery Tribunals, and NCLT forums, they ensure your interests are aggressively yet ethically represented throughout the legal process.

Our CA professionals bring forensic financial analysis capabilities to every case. They meticulously verify claim amounts, reconstruct transactions histories, identify asset trails, and prepare bulletproof financial documentation for legal proceedings. Their expertise ensures that recovery actions are built on unassailable financial foundations, critical when matters escalate to litigation or insolvency proceedings.

Company Secretaries provide invaluable insights into corporate governance, regulatory compliance, and corporate structuring. They navigate the complexities of recovering debts from registered entities, ensuring all actions comply with Companies Act provisions, SEBI regulations where applicable, and corporate insolvency frameworks. Their knowledge of director liabilities and corporate veil piercing is particularly valuable in complex recovery scenarios.

Detailed analysis of debt documentation, debtor profile, and recovery probability

Customized recovery approach based on debt size, debtor capacity, and relationship considerations

Professional communication and negotiation to achieve voluntary settlement

Formal demand through legally binding notices establishing claim and intent

Court proceedings, decree enforcement, and asset recovery as required

Each stage is executed with precision and transparency. We maintain constant communication with clients, providing regular updates on progress, challenges, and recommended actions. Our phased approach maximizes recovery while minimizing costs—many cases resolve favorably before reaching expensive litigation stages.

We operate within the strictest bounds of Indian law and ethical standards. Every action is reviewed by our legal team to ensure compliance with evolving regulations. This commitment protects our clients from legal exposure while maintaining the integrity and enforceability of recovery proceedings.

Specialized recovery for NPAs, retail loans, commercial lending, credit card defaults, and MSME financing. We understand regulatory requirements, provisioning norms, and the urgency of asset classification timelines. Our team works seamlessly with bank legal departments and recovery cells.

Specialized B2B trade credit recovery for manufacturers and distributors, covering dealer networks, supplier payments, and commercial transactions. We focus on protecting your margins and preserving valuable business relationships through strategic recovery approaches.

We provide comprehensive customer evaluation reports and due diligence services, including credit assessment and risk profiling, to help clients reduce the chances of future bad debts. Our preventive measures assist in making informed decisions and avoiding potential financial risks.

Comprehensive recovery services for business-to-business debts, including inter-company receivables, vendor payments, outstanding service contracts, and commercial trade disputes. We prioritize maintaining professional relationships while securing your overdue payments efficiently.

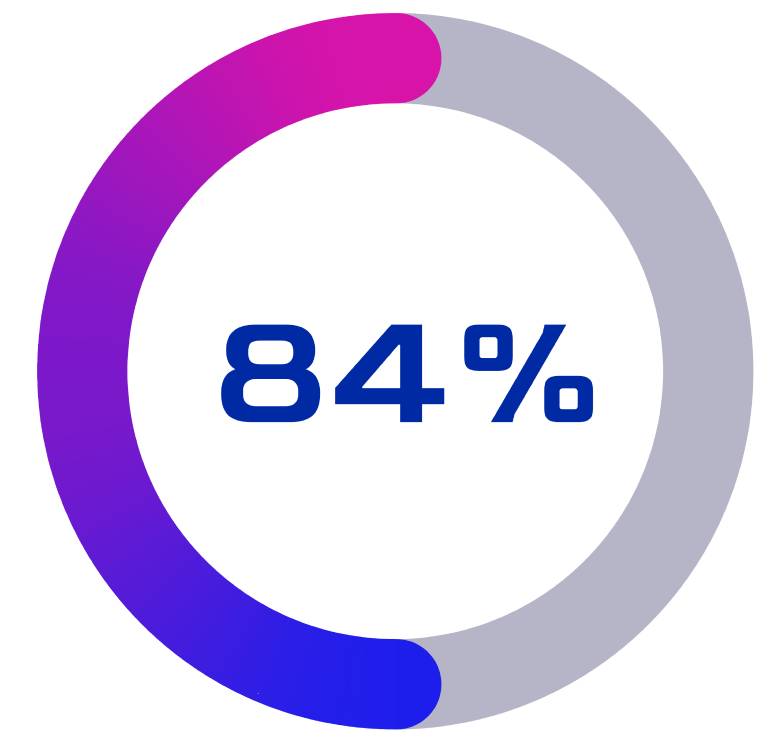

84% across all case types and debt sizes in FY 2023-24.

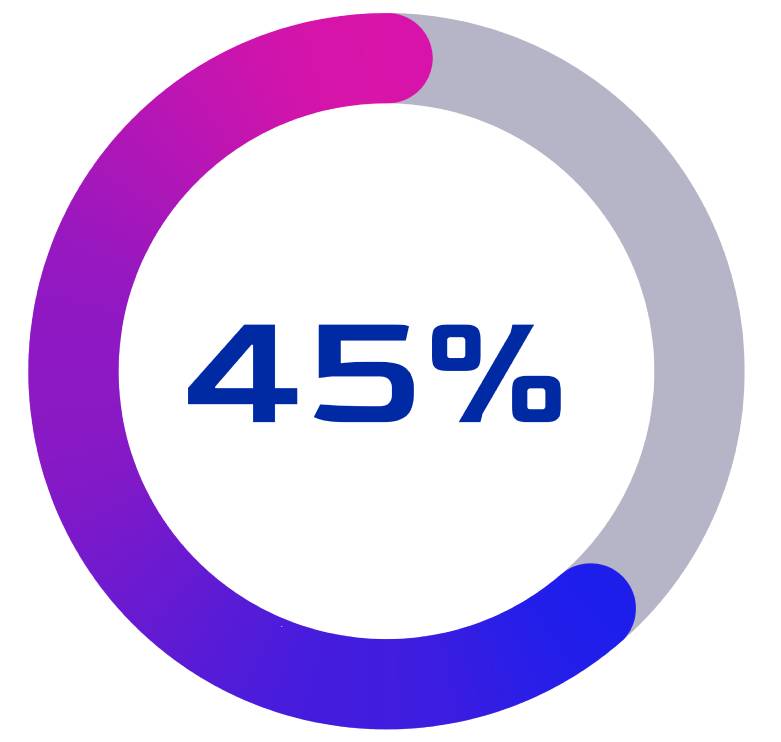

45% compared to internal recovery efforts for similar debt profiles.

95% of businesses that engage us for repeat recovery requirements.

We offer flexible engagement models including contingency-based fees, fixed retainers, and hybrid structures. Our pricing is transparent with no hidden charges. You only succeed when we succeed—our interests are perfectly aligned with yours. The cost of professional recovery services is invariably lower than the combined cost of internal resources, prolonged delays, and potential write-offs.

Unlike aggressive collection agencies, we employ diplomatic, professional approaches that maintain the possibility of future business relationships. Our team distinguishes between genuine financial distress and willful default, tailoring communication accordingly. Many debtors actually appreciate professional handling that protects their dignity while resolving obligations.

Don't let outstanding debts constrain your business growth. Our experienced team of debt collection agents and advocates is what you need to ensure that the your invoices are not outstanding.

We offer a complimentary case assessment to evaluate your recovery prospects and recommend the most effective approach. Whether you're dealing with a single large default or managing a portfolio of overdue accounts, we have the expertise and nationwide presence to deliver results.

Transform your receivables into cash flow. Let our expert team recover what's rightfully yours while you focus on growing your business.

Contact our recovery specialists to discuss your specific requirements and receive a customized recovery strategy proposal.